Thursday, August 22, 2024

Challenge

Equifax’s onboarding process for small-business credit information was manual and time-intensive. Applications arrived as PDF forms and required staff to re-enter data into Salesforce, creating a backlog that stretched processing times up to three weeks and limited the number of clients that could be onboarded.

Solution

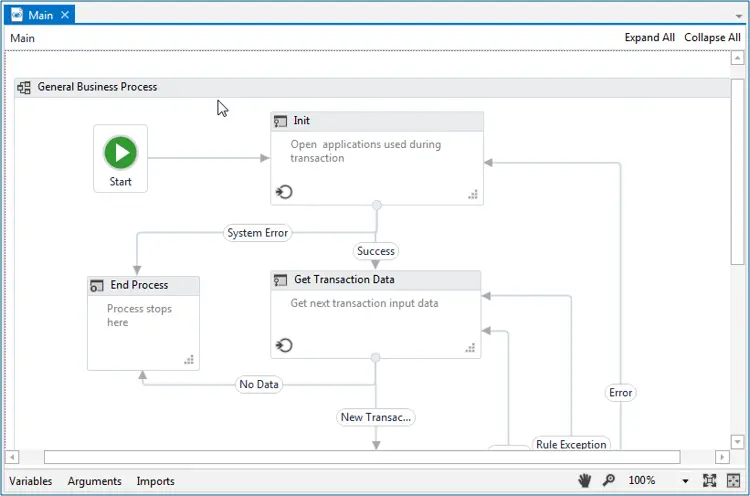

I designed and implemented an end-to-end robotic process automation (RPA) workflow using UiPath to eliminate repetitive data entry and accelerate approvals:

Process Mapping: Documented every step of the existing intake process to identify automation opportunities and compliance requirements.

Automation Build: Developed a UiPath bot to extract information from PDF applications and accurately populate Salesforce records.

Integration & Testing: Created validation checkpoints, handled exceptions, and worked cross-functionally to ensure seamless Salesforce integration and secure data handling.

User Training: Prepared detailed guides and trained the operations team so the new system could be adopted quickly and maintained in-house.

Impact

Reduced onboarding time from up to three weeks to mere minutes, dramatically improving customer experience and internal efficiency.

Delivered annual labor savings exceeding $7,500 by removing manual data entry tasks.

Increased throughput capacity, allowing Equifax to handle more small-business applications without additional staff.

Category:

Corporate Work

Client:

Equifax Canada Co.

Duration:

3 Months

Location:

Toronto ON, Canada